reit dividend tax rate

5 tax rate if the corporate shareholder owns at least 10 of the. As of July 2021 the companys dividend yield stood at 53 on an annual dividend of 065.

Dividend Tax For Shareholders Of A Company Legalzoom

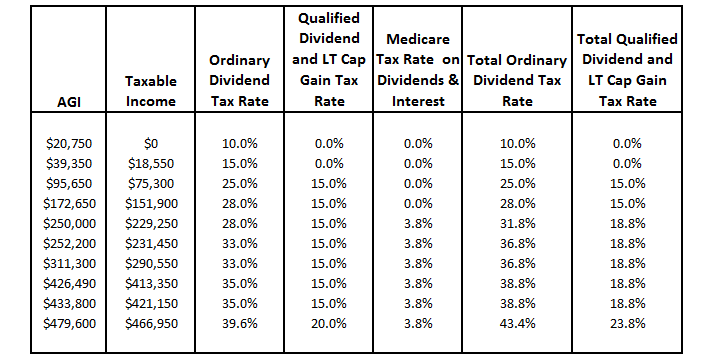

A portion of a REIT dividend payment may be a capital gains distribution which is taxed at the capital gains tax rate.

. As of January 2 2013 the dividend and capital gains tax rate is 20 for investors making over 400000 and households making over 450000. 15 rate 10 rate in Bulgaria and Japan only if. Investor owns 5 or less of a REIT listed on a US.

REIT investors who receive these dividends are taxed as if they are. You get 3000 in dividends and earn 29570 in wages in the 2022 to 2023 tax year. REITs voting stock and in the.

Office Properties Income Trust pays a 220 annual dividend that presently yields a massive 153. Take this off your. By law and IRS regulation REITs must pay out 90 or more of their taxable profits to shareholders in the form of dividends.

The dividends distributed to investors by a REIT can either be considered ordinary income or qualified income. There is no cap on. The stock touched a 52-week low recently of 1221 but has since bounced up.

ROC is referred to as a reduction in adjusted cost base. The dividend is paid with respect to a class of stock that is publicly traded and. The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income returning to 396 percent in 2026 plus a separate 38 percent investment.

REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f REITs gross. AREIT Ayala Land REIT Inc It is the first REIT in the Philippines. The REITs gross income consists of interest and dividends.

Investors receive reports that break down the income and. Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder The trust deducts tax TDS on. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

There is no immediate tax to pay on it as it simply reduces the cost of the share. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US. It requires a good stock tracking system.

Initial Public Offering of the company on Philippine Stock Exchange was August 13 2020. You have a Personal Allowance of 12570. EPR Properties EPR EPR Properties EPR is a small-cap growth REIT that.

According to the United. The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but not for dividends that qualify for the capital gains rates.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. This gives you a total income of 32570. Please refer to the table below.

Ordinary dividends are taxed at the state and federal income tax rates and qualified dividends are taxed at 0 15 or 20 depending on an investors tax bracket. The taxes that you as an investor will pay on those dividends.

The Most Important Metrics For Reit Investing

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

A Short Lesson On Reit Taxation

Perspectives Ldr Capital Management

Tax Tips For Real Estate Investment Trusts Turbotax Tax Tips Videos

Are Real Estate Investment Trusts Reits A Good Investment Right Now The Pros And Cons Financial Freedom Countdown

How To Pay No Tax On Your Dividend Income Retire By 40

Cons Of Reits Disadvantages Of Reits Reit Dividend Taxation

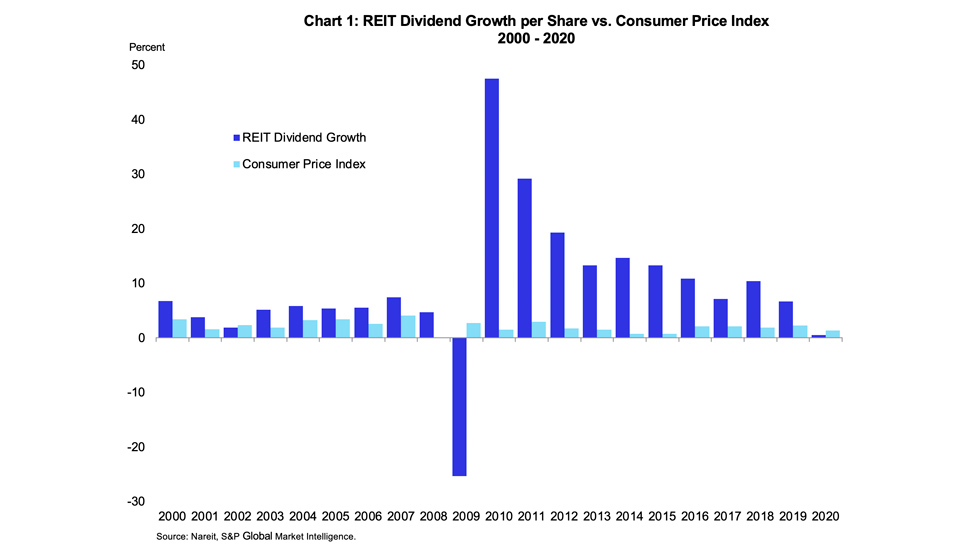

How Reits Provide Protection Against Inflation Nareit

Understanding How Reits Are Taxed

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

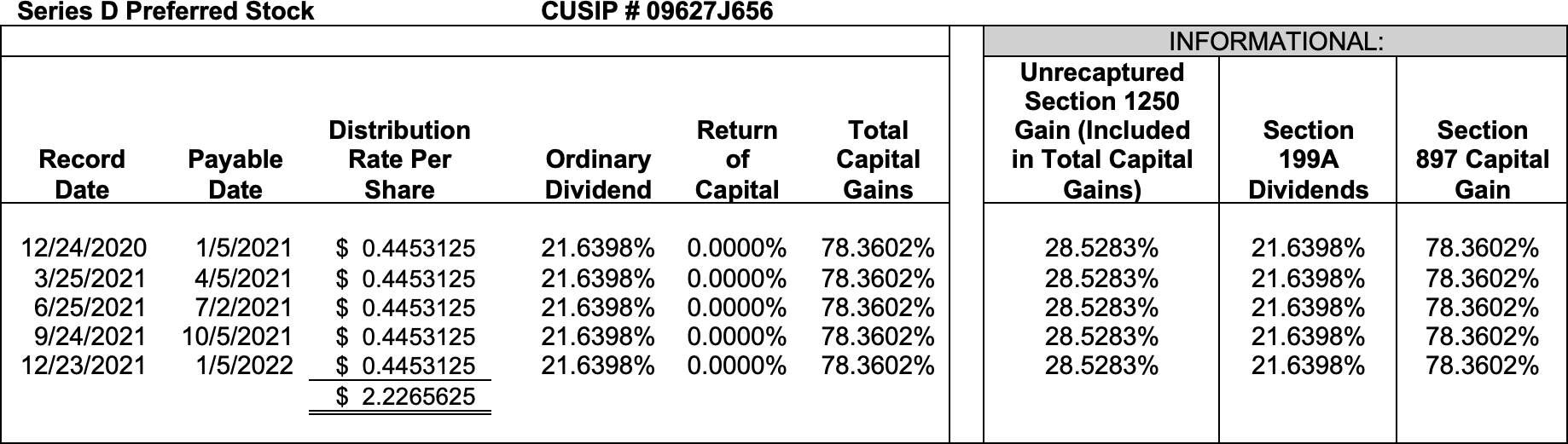

Bluerock Residential Growth Reit Brg Announces 2021 Year End Tax Reporting Information Bluerock Residential Growth Reit

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

How Dividend Reinvestments Are Taxed

Congress Looks At Reit Tax Exemption Wsj

Taxation On Embassy Reit Dividend Stocks Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Effective Tax Rate Formula And Calculator Step By Step

Ordinary Dividends Qualified Dividends Return Of Capital What Does It All Mean Why Should I Care Seeking Alpha